-

El aprendizaje automático hace que los botones de tela sean prácticos

Toda la industria tecnológica necesita desesperadamente una HMI (interfaz hombre-máquina) portátil y conveniente. Los dispositivos más comentados en el CES de este año fueron el Rabbit R1 y el Humane AI Pin, los cuales intentan optimizar las interfaces portátiles con y para la IA. Ambos tienen muchos inconvenientes, como la mayoría de los otros enfoques.…

-

El aprendizaje automático hace que los botones de tela sean prácticos

Toda la industria tecnológica necesita desesperadamente una HMI (interfaz hombre-máquina) portátil y conveniente. Los dispositivos más comentados en el CES de este año fueron el Rabbit R1 y el Humane AI Pin, los cuales intentan optimizar las interfaces portátiles con y para la IA. Ambos tienen muchos inconvenientes, como la mayoría de los otros enfoques.…

-

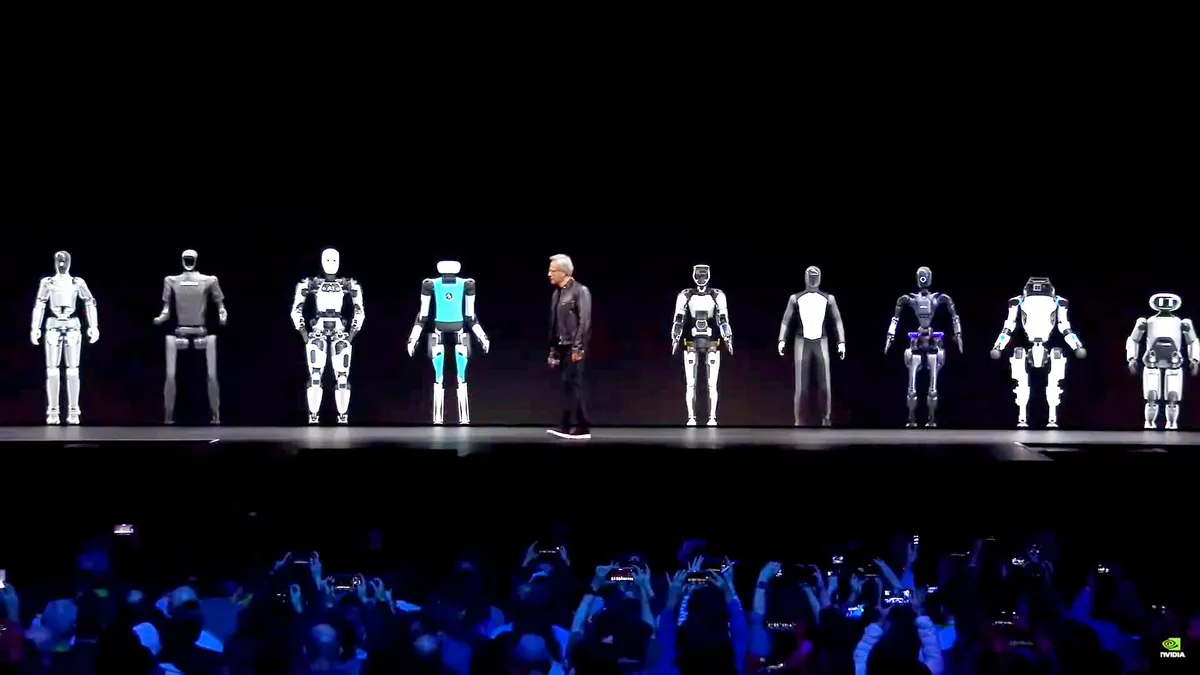

#3 111 – Semana de la IA: Proyecto GRANDE

#3 111 – Semana de la IA: Proyecto GRANDE 18 de abril de 2024 por Craig Shames Hoy temprano, Boston Dynamics presentó la última versión de su robot ATLAS, ahora equipado con una destreza increíble. Pero para que estos robots humanoides sean útiles en entornos industriales y del mundo real, necesitarán estar impulsados por una…

-

Actualización sobre las misiones semanales: los mejores mazos de Hearthstone

Blizzard acaba de publicar una entrada de emergencia en el blog sobre los cambios de las misiones semanales de ayer. Después de que se lanzó el parche 29.2, los jugadores notaron que los requisitos en la mayoría de sus misiones se han triplicado. Las recompensas también aumentaron, pero no tanto (alrededor de un 25% si…

-

“El Real Madrid nunca muere” – Carlo Ancelotti saludó los intentos contra el Manchester City

El Real Madrid ha progresado el miércoles, en las semifinales de la Liga de Campeones de esta temporada, cuando eliminaron al Manchester City en los penaltis en su propio patio. La eliminatoria acabó 4-4 en el global tras 210 minutos, pero al final fueron los blancos los que se impusieron, ganando 4-3 en los penaltis.…

-

Bucură-te de viață: un antrenament de pionierat în Valencia care îmbină coaching-ul, neuroștiința și clownajul terapeutic – Știri din Valencia

Antrenamentul este condus de antrenoarea franco-valențiană Brigitte Blandin și va avea loc pe 27 aprilie la Haku Space din oraș. ANTRENAMENTUL CARE TRANSFORMĂ VIEȚILE… De ani de zile, au existat nenumărate cursuri, ateliere, antrenamente și retrageri în Spania. Dezvoltare personala care urmăresc să transforme, într-un fel sau altul, viața oamenilor. În prezent, societatea este în…

-

O mașinărie cu inteligență artificială promite să pună capăt gropilor – Știri din Spania

O nouă soluție tehnologică ar putea schimba peisajul întreținerii drumurilor: ARRES (sistem autonom de reparații rutiere), un sistem alimentat de inteligență artificială care integrează roboți autonomi pentru a detecta și repara gropile și fisurile de pe drumuri. Acest avans, dezvoltat în Regatul Unitar putea însemna sfârșitul problemelor pe care gropile le cauzează bicicliștilor și șoferilor.…

-

Alcampo scoate la sorți veselă completă Bidasoa – cadouri și mostre gratuite – Știri de agrement

Completați formularul pentru a participa la tombolă La camp deoarece premiul va fi o veselă din colecția Oslo de la Bidasoa. Bidasoa este un brand cunoscut în lumea ospitalității pentru varietatea sa mare de produse din sticlă și veselă. De asemenea, este cunoscută pentru că oferă colecții cu modele diferite Cu această ocazie, colecția completă…

-

Insomnie: Ce se întâmplă cu creierul nostru când nu dormim suficient

Insomnia este una dintre cele mai comune probleme de somn întâmpinate de oameni. Se estimează că aproximativ o treime dintre adulți au experimentat insomnie cel puțin o dată în viață. Insomnia poate fi cauzată de o varietate de factori, cum ar fi stresul, anxietatea, depresia, sau chiar obiceiurile proaste de somn. Indiferent de cauza, insomnia…

-

Munich Composites lleva la producción de llantas de fibra de carbono tejida a EE. UU.

Hace unos años, Boyd Johnson (de Boyd Wheels) y yo estábamos compartiendo una cerveza y él mencionó que algún día quería hacer llantas de fibra de carbono trenzadas. Un avance rápido hasta el día de hoy, y ya es una realidad. Él y algunos otros adquirieron Munich Composites en Alemania, que fabrica llantas de fibra…